Business Insurance in and around Downey

Downey! Look no further for small business insurance.

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Downey! Look no further for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Lucy Rodas is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Lucy Rodas can help you file your claim. Keep your business protected and growing strong with State Farm!

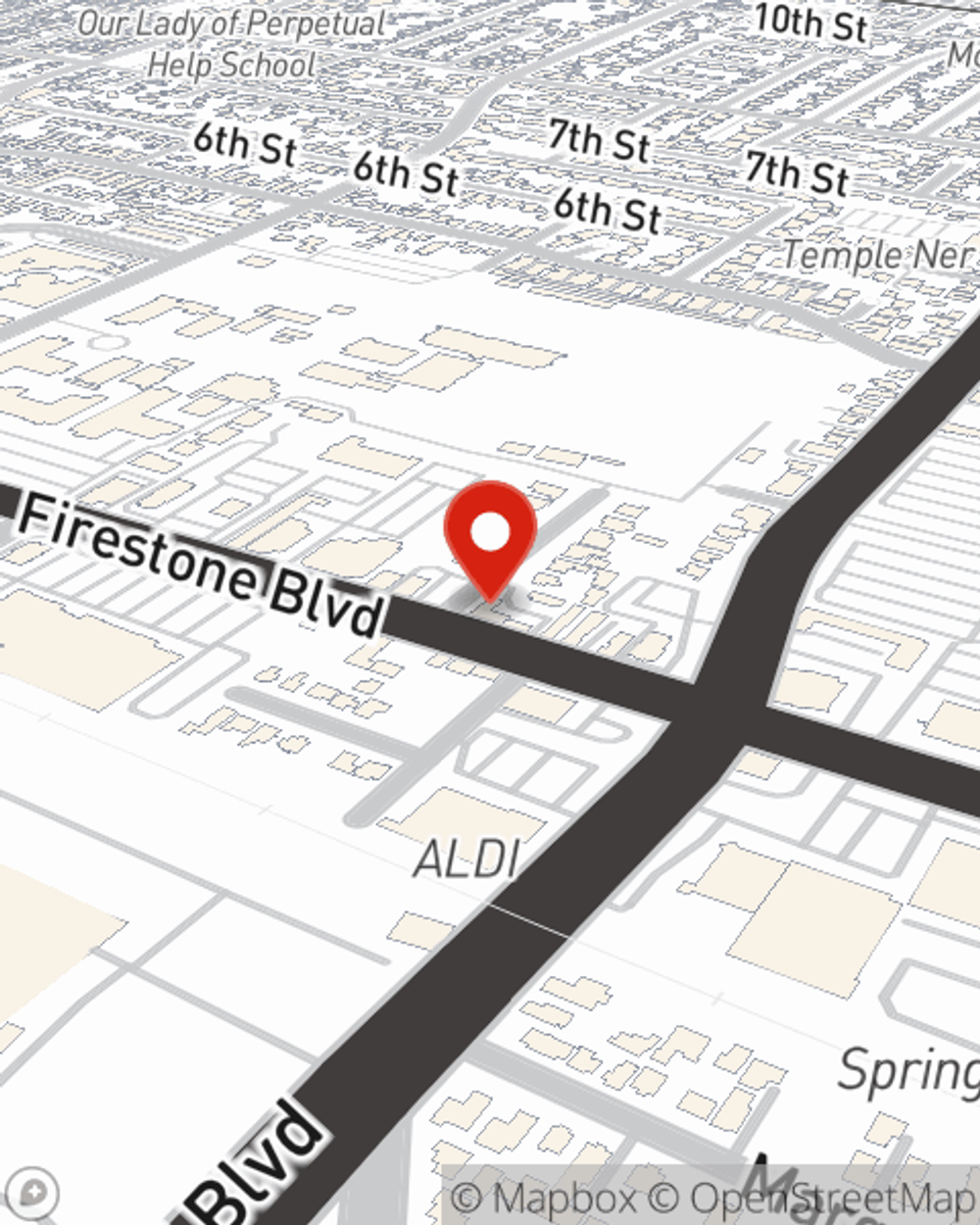

Ready to identify the specific options that may be right for you and your small business? Simply visit State Farm agent Lucy Rodas today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Lucy Rodas

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.